33+ Self employed mortgage calculator

Before submitting a decision in principle why not use our handy residential affordability calculator to check how much your client could borrow for the application property. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 71612 a month while a 15-year term might cost a month.

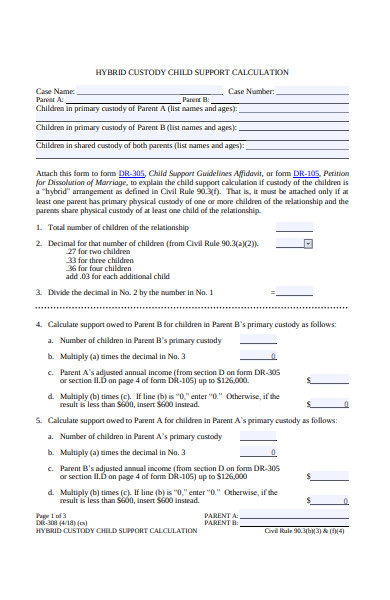

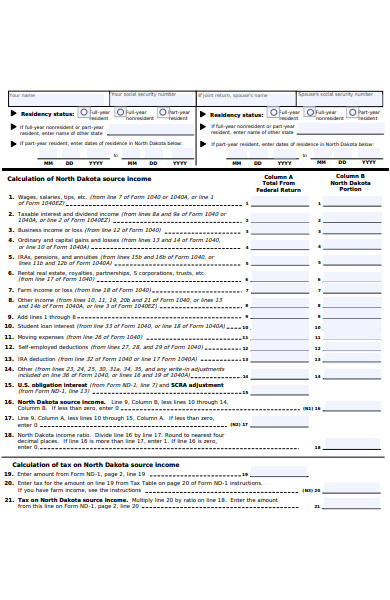

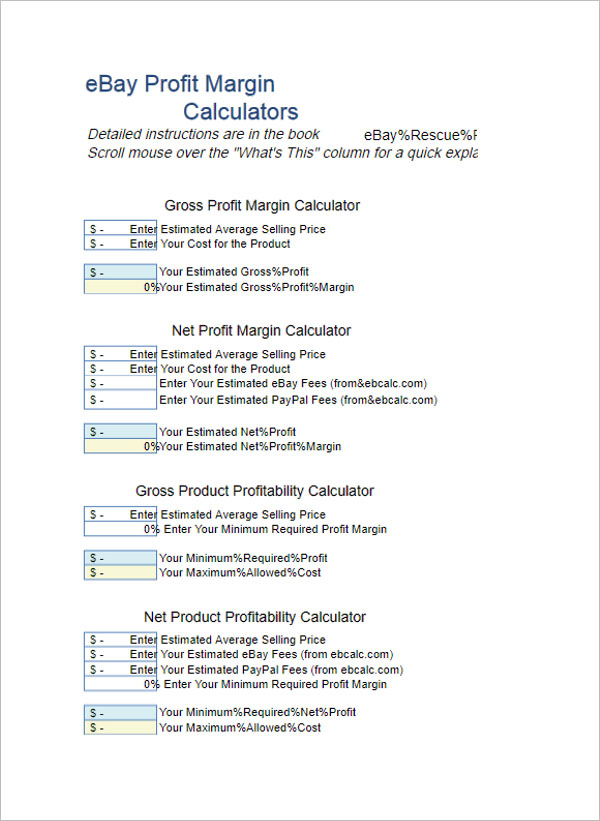

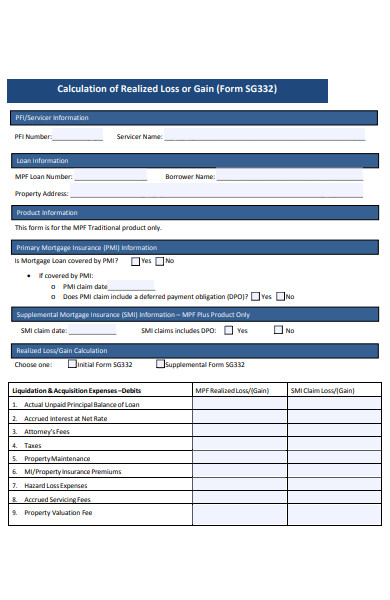

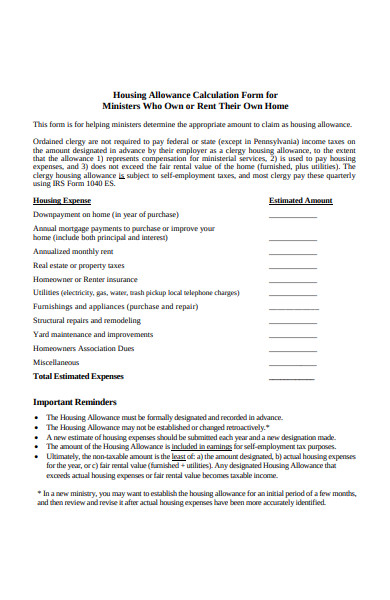

Free 31 Calculation Forms In Pdf Ms Word

Since the year 2000 FHA loan rates were usually 0125 to 025 higher than conventional loans.

. They require proof of income such as a statement from your accountant. There is a good chance your disposable income may meet the requirement to be deemed affordable for a mortgage of this size. It is a comparison of the average advertised Big 6 bank special offer rate versus.

For help filling in this calculator correctly please refer to our full lending criteria and product guide before you begin. Mortgage Calculator with Lump Sums. Enter the original Mortgage amount or the last mortgage amount when remortgaged Enter the monthly payment you make.

Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage. Note that your monthly mortgage payments. If youre self-employed you may have some extra steps when buying a home.

To use it all you need to do is. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. Do you have any other regular income.

Bonus commission overtime child benefit tax credits or child maintenance. 1000000 This would be considered high-risk LVR by the lender so they would require LMI for your loan. Using our Mortgage Balance Calculator is really simple and will immediately show you the remaining balance on any repayment mortgage details you enter.

500 cashback or free legal fees. Length of Mortgage Term. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

For all other areas of the UK please use the UK Salary Calculator. Help With Our Mortgage Balance Calculator. Shared Ownership Mortgage Calculator Use this calculator to get an idea if the mortgage you want is affordable.

339 Fixed for 2 years. You can calculate your mortgage qualification based on income purchase price or total monthly payment. 1 year 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years 36 years 37.

If you are self-employed expect lenders to ask for additional documentation. Calculator is for illustrative. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more.

Savings is over five years. 1500 100 400 2000 If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent 2000 is 33 of 6000. Mortgage Loan Auto Loan Interest Payment Retirement Amortization Investment Currency Inflation Finance Mortgage Payoff Income Tax Compound Interest Salary 401K Interest Rate Sales.

In addition to using the above affordability calculator you may want to check out our monthly mortgage repayment calculator to estimate your monthly payments for various loan scenarios. This mortgage calculator gives a detailed breakdown of up to two mortgages and calculates payment schedules over your full amortization. Get FREE mortgage quotes without pulling your credit score.

A fixed-rate mortgage means your interest rate will stay the same for the term of the deal. While others may only count it at a reduced rate of 50. With Butler Mortgage you will find the lowest fixed variable mortgage rates deals in Ontario.

If you borrow 900000 against a property valued at 1000000 then what would your LVR be. 1 the average discounted discretionary rate at the Big 6 banks as tracked by Butler Mortgage 2 the average broker rate as tracked by MortgageDashboardca and 3 the lowest conventional full-featured 5-year fixed rate at Butler Mortgage as of March 14 2017. For those who are self-employed you must provide.

Think of it as a maximum borrowing power calculator helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings. Employed Self Employed Annual Income Bonus current year. This calculator helps you work out the most you could borrow from the bank to buy your new home.

Current Redmond mortgage rates are shown beneath the calculator. Monthly payments on a 150000 mortgage. Over the years FHA mortgage rates have generally been higher than conventional mortgage rates.

You can use our mortgage interest rate calculator to work out how much interest you might pay. This is called your borrowing power. Before-tax price sale tax rate and final or after-tax price.

Estimating your monthly payment with our mortgage calculator or looking to prequalify for a mortgage. If you wish to calculate your income tax in Scotland before the income tax rate change in 201718 you can use the pre 201718 Scottish Income Tax Calculator. But except for the years following the late 2000s financial crisis 2010 2015 for a couple of years FHA loan rates were lower than conventional.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. A variable-rate mortgage can change month to month so you wont always pay the same amount. Example of how to calculate LVR.

Net profit if self-employed or pension income if retired. We also generate graphs summaries of balances payments and interest over the life of your mortgage. In general obtaining a mortgage when youre self-employed can be more challenging.

This Salary and PAYE calculator is purely for those subject to PAYE rules and regulation which falls under Scottish control. By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender. You need to prove you have a reliable income.

Heres a breakdown of what you might face monthly in interest and over the life of a 150000 mortgage. You may also enter extra lump sum and pre-payment amounts. The calculator is updated for the UK 2022 tax year which covers the 1 st April 2022 to the 31 st March 2023.

Let us know a bit about your mortgage and your spending to see what extra we may be able to lend you on your mortgage.

Stunning 3 Bedroom Villa For Sale In Clos Du Littoral

Free 31 Calculation Forms In Pdf Ms Word

33 Profit And Loss Statements Examples Free Pdf Word Templates

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

The Home Buying Process In 10 Simple Steps Great Tips For First Time Home Buyers Realestate Home Buying First Home Buyer Buying First Home

32 Expense Sheet Templates In Pdf Free Premium Templates

![]()

Be An Independent Adult

![]()

Be An Independent Adult

Free 31 Calculation Forms In Pdf Ms Word

Avoid Foreclosure Moshes Law Firm 888 445 0234

Check Out This Behance Project Sign In Login Screens Https Www Behance Net Gallery 50803309 Sign In Login Screens Signs Screen Login

![]()

Be An Independent Adult

Pin On Naca Event Locations

Flat Lay Top View Office Table Desk Workspace With Calculator Pen Laptop Note On The Pastel Blue Background Copy Space For Text Empty Blank To Word Business Finance Education Technology Concept Background Wall

![]()

Be An Independent Adult

Free 31 Calculation Forms In Pdf Ms Word

![]()

Be An Independent Adult